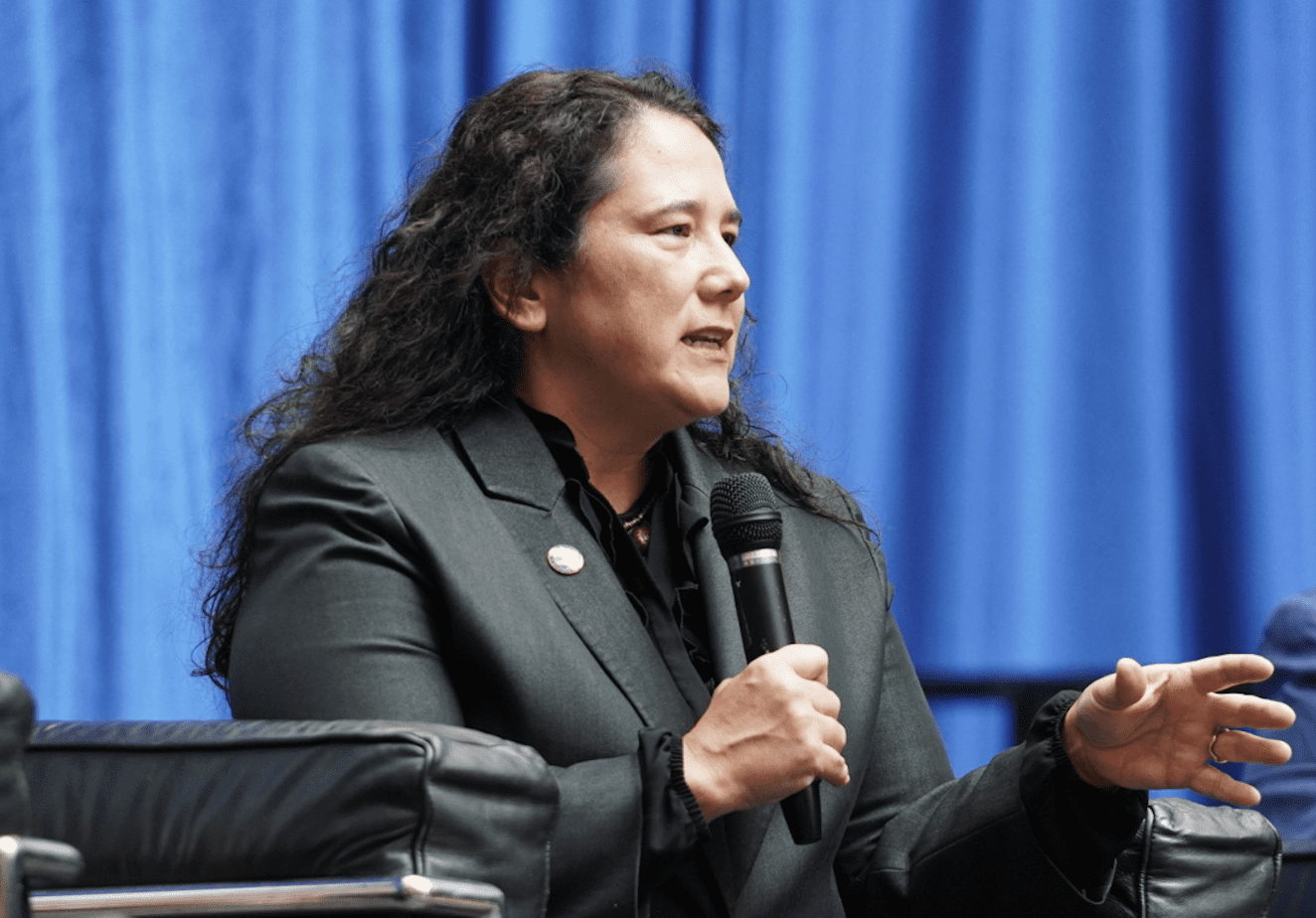

Isabella Casillas Guzman is the 27th administrator of the U.S. Small Business Administration, and on Sept. 23 she took a few minutes to speak with Negocios Now while she was between events during a visit to Chicagoland.

Guzman’s responses have been edited for length and clarity.

Negocios Now: What brings you to the city?

Guzman: I just left Congressman (Bill) Foster (D-Naperville) at the Bolingbrook Chamber of Commerce where we met with Latino-owned small businesses and resource partners who are looking to support them, and I’m on my way to join Sen. (Tammy) Duckworth for a series of meetings this afternoon.

Of course it’s Hispanic Heritage Month, and we want to make sure we’re connecting with Latino-owned businesses to understand some of the impacts that SBA relief has had and to understand the challenges and opportunities they’d like the SBA to help them with.

Negocios Now: What main challenge do you think small businesses are facing today?

Guzman: Right now, as always, we’re hearing from small businesses that access to capital continues to be a dominant issue. But as well, it’s about building revenues, getting customers back, maybe adopting digital technologies to better connect with consumers, or it’s about government contracting and figuring out how to get certified to do business with the federal government.

Negocios Now: How, specifically, is the SBA helping small businesses to have more opportunity with the federal government?

Guzman: We have partners in our district offices who work with small businesses to, first, enter the federal space with certifications as applicable. We’re streamlining our certification programs online and have already rolled out technology improvements to make it easier to get certified.

We had a record year last year in federal contracting, over $154 billion to small businesses.

Negocios Now: In the 2021 fiscal year you were up $8 billion in small business federal contracting over the previous year. Do you have a target for this year?

Guzman: We want to meet the minimum of 25%, but I will lean in on one area that President Biden has outlined as a priority: ensuring that small disadvantaged businesses can access federal contracting. That’s where we continue to see disparities.

Last year we reached a historic 11% (of contracts for small disadvantaged businesses), one year ahead of the goal of 15% by 2025.

Negocios Now: We know the Biden administration has taken a big step with the Inflation Reduction Act. What do you expect with this?

Guzman: The Inflation Reduction Act provides tax rebates and credits to lower the cost of healthcare, lower costs of prescription drugs, lower costs of energy. In that area of energy costs, small businesses can take advantage of tax incentives and rebates to build sustainability in their business, whether that’s getting an electric vehicle or putting in solar.

Negocios Now: What do you expect in the next year for small businesses without the pandemic?

Guzman: I’m hoping the SBA can transition and transform some of its products so we can better meet businesses where they are, recognizing who those entrepreneurs are, more women and people of color. But also we need to create an inclusive system.

Negocios Now: Healthcare is another issue you are working on?

Guzman: So, first and foremost, the Inflation Reduction Act lowers healthcare costs. In addition to that, we’re working through our small business digital alliance to bring large companies that want to help grow small businesses by giving them digital tools online. And that includes some of our corporate partners who are providing tools on how to design and strategize strong benefit plans for employees.

David Steinkraus

Negocios Now